Tags

Investors can earn a significant return in a short time, but this means they can also lose a lot of money in a short amount of time. Whether you are a financial advisor, family office, institutional investor, or a recent high school graduate, there are different objectives as well as risk tolerances for investing in cryptocurrencies which must be understood. As with any investment, one should clearly ascertain the risk versus reward and the opportunity cost. If you are considering investing in crypto, understanding the potential pitfalls of cryptocurrency trading risks is essential to success.

What is Cryptocurrency Trading?

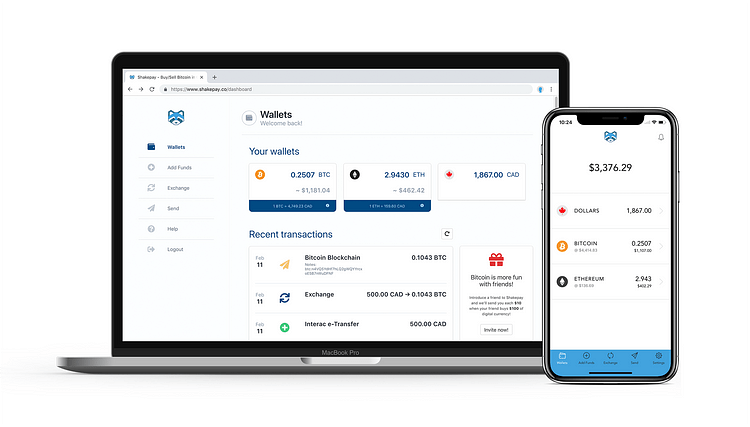

Cryptocurrency trading is the process of buying and selling digital currencies to make a profit. It involves speculating on the price movements of different cryptocurrencies, such as Bitcoin, Ethereum, Litecoin, etc., with the goal of generating returns from short-term market fluctuations.

Definition: “Cryptocurrency Trading” is an online activity that allows investors to buy and sell digital assets using various exchanges. Traders can speculate on the future value of a particular cryptocurrency by purchasing coins at one price and then selling them at another when they believe it has reached its peak or bottomed out.

Benefits of Cryptocurrency Trading: One major benefit associated with cryptocurrency trading is that it offers investors access to a global marketplace without any geographical restrictions or limitations imposed by traditional financial institutions. Additionally, traders can take advantage of high liquidity levels within these markets which allow for quick execution times and low transaction fees compared to other asset classes such as stocks or commodities. Finally, crypto traders also have access to sophisticated tools like charting software which can help them identify potential entry points into trades more accurately than ever before.

Despite all its advantages, there are still risks associated with cryptocurrency trading that should be taken into consideration before investing in this asset class. Firstly, due to their volatile nature prices can fluctuate significantly over short periods making it difficult for even experienced traders to predict where prices will go next, meaning profits could easily turn into losses if not managed properly. Secondly, because most exchanges operate outside government regulation there is always a risk that funds may be lost through hacking attacks or fraudsters taking advantage of unsuspecting users who do not know how best to protect themselves online. Finally, some countries may impose taxes on profits made from crypto investments, so it is important for individuals living in those jurisdictions to understand what their obligations are beforehand, so they do not get caught out later down the line.

Cryptocurrency trading is an exciting way to invest in digital assets, but it comes with certain risks that should be considered. In the next section, we’ll discuss some of the key risks associated with crypto trading so you can make informed decisions about your investments.

Understanding the Risks of Crypto Trading

Cryptocurrency trading can be a lucrative venture, but it is important to understand the risks associated with this type of investment. Volatility risk is one of the most significant risks when trading cryptocurrencies. Cryptocurrencies are known for their high volatility and prices can change drastically in a short period of time. This means that traders need to be prepared for sudden price changes and have strategies in place to manage them effectively.

Liquidity Risk: Liquidity risk is another major concern when trading cryptocurrencies. Liquidity refers to how easily an asset can be bought or sold without affecting its price significantly. Low liquidity means that it may take longer to buy or sell large amounts of cryptocurrency, which could lead to losses if the market moves against you before your order has been filled.

Regulatory Risk: Regulatory risk is also something that traders should consider when investing in cryptocurrencies as regulations vary from country to country and even within countries themselves. It is important for investors to stay up to date on any new laws or regulations related to cryptocurrency trading so they do not get caught off guard by unexpected changes in policy that could affect their investments negatively.

Security Risk: Finally, security risk must also be considered when dealing with cryptocurrencies as there have been numerous cases of hacking attacks resulting in stolen funds over the years due to weak security protocols employed by exchanges and other platforms offering crypto services. To minimize this risk, investors should only use reputable exchanges with strong security measures such as two-factor authentication (2FA) and cold storage solutions like hardware wallets whenever possible.

Crypto trading can be a risky venture, but understanding the risks involved is key to minimizing them. By following these tips and doing your research, you can make informed decisions that will help protect your investments. Now let’s look at how to minimize those risks.

Tips for Minimizing Crypto Trading Risks

Diversifying Your Portfolio: Diversifying your portfolio is one of the most important steps you can take to minimize risk when trading crypto. By spreading out your investments across different coins, exchanges, and wallets, you reduce the chances of any single investment going sour. This way, if one coin or exchange experiences a dip in value or security breach, it won’t affect all your holdings.

Setting Stop Losses and Take Profits: Setting stop losses and take profits is another key strategy for minimizing risk while trading crypto. Stop losses are predetermined points at which traders will sell their assets to avoid further losses should the market move against them. Take profits are predetermined points at which traders will sell their assets to realize gains should the market move in their favor. Setting these limits helps ensure that investors do not get too greedy or too fearful when trading crypto and keeps them from making rash decisions based on emotion rather than logic.

Researching: Researching before investing is essential for reducing risks associated with cryptocurrency trading as well. It is important to understand how each coin works before investing so that you know what kind of returns to expect and whether it fits into your overall investment strategy. Additionally, researching an exchange prior to using it can help identify potential issues such as slow customer service response times or inadequate security measures that could put your funds at risk down the line.

By following these tips, traders can minimize their risks when trading crypto and make informed decisions. However, it is also important to be aware of common mistakes that can lead to costly losses to maximize returns on investments.

Common Mistakes to Avoid When Trading Crypto

To minimize the potential for losses, traders should avoid common mistakes such as not setting stop losses or take profits, not doing enough research, and not understanding the technology behind the currency.

Not Setting Stop Losses or Take Profits: One of the most important steps in crypto trading is to set up stop losses and take profits. A stop loss order is an automated instruction that closes out your position if it reaches a certain price level. This helps protect you from large losses if the market moves against you unexpectedly. Similarly, a take profit order will close out your position when it reaches a certain price level so that you can lock in gains before they disappear due to market volatility. Not having these orders in place could lead to major losses if prices move suddenly against your positions.

Not Doing Enough Research: Before investing in any cryptocurrency, traders should do their own research on its fundamentals and technicals to determine whether it is worth investing in at all. Without researching what factors are driving the coin’s price movements, investors may find themselves stuck with coins whose value has dropped significantly without warning due to external events outside of their control or knowledge about them beforehand.

Not Understanding The Technology Behind The Currency: Crypto assets are built on blockchain technology which is still relatively new, and complex compared to traditional financial markets like stocks and bonds where there are decades of data available for analysis by investors who understand how these markets work inside-out. As such, many crypto traders lack an understanding of how blockchains operate which makes them vulnerable when making decisions about which coins they should invest in since they do not have full insight into what’s going on under-the-hood with each asset’s underlying technology stack.

Overall, avoiding common mistakes while trading cryptocurrencies can help reduce risk exposure and increase chances for success over time through smart decision making based on thorough research and understanding of both fundamental and technical aspects related to each coin being traded.

It is important to be aware of the risks associated with crypto trading and to take steps to minimize them. By avoiding common mistakes, such as not setting stop losses or taking profits, doing adequate research, and understanding the technology behind the currency, traders can increase their chances of success when investing in cryptocurrency. Now let’s look at whether crypto is worth the risk.

Conclusion – Is Crypto Worth the Risk?

Before deciding whether to invest in crypto assets or not, it is important to understand the potential rewards and drawbacks of doing so.

Pros and Cons of Crypto Investing: Cryptocurrencies offer investors the potential for high returns due to their volatility. They are decentralized, meaning they are not subject to government regulation or manipulation by central banks. Additionally, cryptocurrencies provide users with anonymity as transactions are conducted on a peer-to-peer basis without any third-party involvement. On the other hand, cryptocurrencies are highly volatile and there is no guarantee that investments will yield positive returns over time. Furthermore, there is an inherent risk associated with investing in unregulated digital currencies since they lack legal protection from fraud or theft.

Ultimately, whether investing in cryptocurrency or not is worth the risk depends on individual circumstances and preferences. Investors should conduct thorough research before making any decisions about investing in crypto assets and consider all possible risks associated with such investments including market volatility, liquidity issues, security threats and regulatory uncertainty among others. Additionally, investors should diversify their portfolios across different asset classes to minimize losses if one particular asset fails to perform as expected. Finally, investors should set stop losses and take profits when trading cryptos so that they do not end up losing more than they initially invested due to sudden price movements caused by market speculation or news events related to specific coins/tokens.

Michel Ouellette JMD, ll.l., ll.m.

JMD Live Online Subscription link.

J. Michael Dennis, ll.l., ll.m.

Business &Corporate Strategist

Systemic Strategic Planning

Quality Assurance, Occupational Health & Safety, Environmental Protection, Regulatory Compliance, Crisis & Reputation Management

Skype: jmdlive

Email: jmdlive@jmichaeldennis.live

Web: https://www.jmichaeldennis.live

Phone: 24/7 Emergency Access

Available to our clients/business partners

Disclaimer: All write-ups and articles do not constitute financial and legal advice in any way whatsoever but for information purposes only.

When making financial and legal decisions and commitments, we strongly recommend you consult your professional financial and legal services provider. Our website uses referral links to various crypto exchanges as a means of monetization. We appreciate it if you choose to use the in-article links, but the decision is ultimately yours.

You must be logged in to post a comment.