Tags

BitBuy, bitcoin, Bitcoin Well, Bitget, blockchain, coinbase, crypto, cryptocurrency, NDAX.io, Netcoins, Newton, Shakepay, Uphold

Selecting a crypto exchange in Canada can be complicated because the country has strict regulations for crypto markets. Even major crypto trading platforms like Binance and ByBit had to leave Canada, leading to troubles for their Canadian users. So, it is essential to be careful and make a wise choice when picking a crypto trading platform if you plan to start trading in cryptocurrency.

Here are the best 2024 Canadian Cryptocurrency Exchanges based on consumer ratings, reports, and personal experience in 2023:

Bitbuy

Bitbuy is a Canadian cryptocurrency exchange, caters primarily to Canadian users, allowing deposits in Canadian dollars via Interac e-Transfer and wire transfer. The platform is designed to accommodate both beginners and advanced traders. It offers a diverse range of cryptocurrencies, including popular options like Bitcoin, Ethereum, Litecoin, and newer additions such as Solana, Cardano, and Polygon, with a commitment to continuously expanding its coin selection.

Bitget

Bitget is a global exchange catering to skilled users and offers a vast selection of altcoins for Canadian crypto traders. While deposits in cryptocurrency are free, purchasing crypto with CAD requires a debit card or a third-party bank transfer service like Banxa. For this reason, using Bitget’s P2P marketplace is recommended where you can buy USDT in Canada with Interac e-transfer commission free and use it for trading crypto on the platform. Compared toBitbuy, it offers over 1000 cryptocurrency coins, so it is the perfect choice for people who like to invest in altcoins.

Uphold

Released in 2015, Uphold is the best crypto exchange for multi-asset trading in Canada. Not only can you trade 60+ popular digital currencies but you can also trade US stocks or precious metals. This is why many Canadian crypto investors prefer Uphold over others. Uphold, a versatile cryptocurrency exchange, offers a unique range of deposit methods including credit/debit cards, direct cryptocurrency deposits, equities, and even precious metals. This exchange supports multiple currencies such as Canadian dollars (CAD), USD, and Euros, making it accessible for a global user base.

Netcoins

Netcoins is fast becoming one of Canada’s most reputable and trusted crypto exchanges. Netcoins is great for beginners because it is easy to use. Netcoins has a lot of good features including free deposits and withdrawals, excellent customer support and their own crypto card which offers 1% cashback paid in bitcoin on all purchases. Netcoins has the largest referral bonus of any crypto exchange. If you refer a friend and they buy $100 worth of crypto, you’ll both get $25.

Bitcoin Well

Bitcoin Well focus solely on Bitcoin. you won’t find an array of other coins here. However, if Bitcoin is solely what you’re after. Users can add Canadian dollars to their accounts using an Interac e-Transfer, wire transfer, Visa debit, or even through Bitcoin ATMs. The crypto platform exclusively deals in Canadian dollars (CAD), making it a straightforward choice for Canadian users.

Newton

Newton is one of the best beginner-friendly crypto exchanges with low trading fees in Canada. It offers popular digital currencies such as Bitcoin, Ethereum and Polkadot as well as many other altcoins that we think may explode in 2024. One of the key advantages of using Newton is its fee structure. The platform offers 0% fees for CAD funding, CAD withdrawals, and crypto deposits/withdrawals, with up to a $5 network fee waiver. Additionally, Newton does not charge commissions or trading fees, making it an economically attractive option for traders. Newton supports various deposit methods, including Interac e-Transfer, Wire transfer, and the ability to directly connect a bank account, which is particularly convenient for users dealing with Canadian dollars. Newton’s ease of use and focus on popular cryptocurrencies make it the premier choice for beginner traders in Canada’s cryptocurrency market. The best thing about Newton is the crypto assets they offer, and they grow this list every month. They currently offer over 70+ cryptocurrencies which makes them the best Canada-based crypto exchange when it comes to crypto selection. If you’d like more advanced trading features, Newton is working on a Pro trading platform that is currently in its Beta stage.

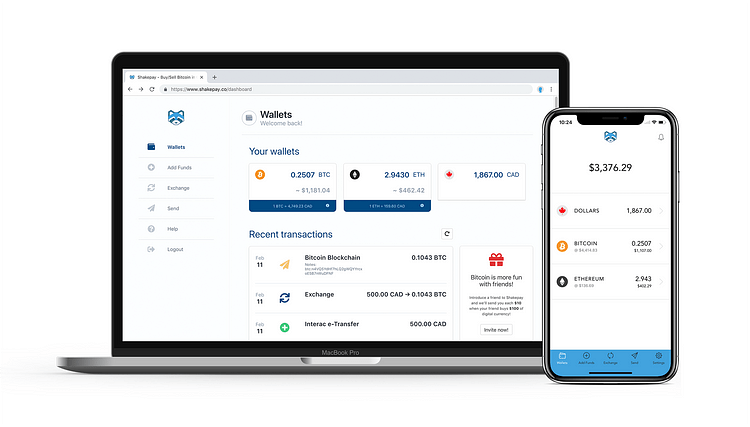

Shakepay

Shakepay is a Montreal-based trustworthy exchange that offers free and fast deposits and withdrawals and is considered one of the best Canadian crypto exchanges for beginners. You can deposit Canadian dollars (CAD) via Interac e-Transfer or wire transfer. Shakepay offers two coins only: Bitcoin and Ethereum. This narrow range might be a drawback for traders looking to diversify their cryptocurrency portfolio. Shakepay offers a unique referral program where, if you refer a friend who signs up using your referral link, you can shake your phone every day to receive small amounts of Bitcoin. The more people you refer, the more Bitcoin you earn. The only downside is remembering to shake your phone every day to receive your rewards. Like Netcoins, they also offer a crypto visa card, which you can use Canada-wide and receive cashback in Bitcoin.

NDAX.io

NDAX is a beginner-friendly crypto exchange that offers a good amount of popular digital currencies. It is the only Canadian crypto exchange that offers crypto staking. NDAX is one of the best crypto exchanges and is a good starting point for Canadians looking to purchase crypto for the first time. NDAX offers a variety of deposit methods including Interac e-Transfer, Wire transfer, and Bank draft, all catering to Canadian dollars (CAD). This makes it a convenient crypto platform for Canadian users.

Coinbase

Coinbase, a globally renowned crypto exchange offering Interac e-Transfer for Canadian users, simplifying fund deposits. This feature allows easy and convenient deposit of funds from any Canadian online bank account, addressing a major hurdle for Canadian crypto traders. However, the fees on Coinbase are among the highest in the crypto exchange industry. While Coinbase has built a reputation as an ideal platform for novice traders, thanks to its simplicity and robust security measures, these high fees significantly impact its attractiveness. Novice traders often prioritize ease of use and security in their trading platforms, both of which Coinbase excels at. However, the cost of trading on Coinbase, due to its high fees, is a major downside that cannot be overlooked.

Michel Ouellette JMD, ll.l., ll.m.

JMD Live Online Subscription link.

J. Michael Dennis, ll.l., ll.m.

Personal & Corporate Fixer

Skype: jmdlive

Email: jmdlive@jmichaeldennis.live

Web: https://www.jmichaeldennis.live

Phone: 24/7 Emergency Access

Available to our clients/business partners

Disclaimer: All write-ups and articles do not constitute financial and legal advice in any way whatsoever but for information purposes only.

When making financial and legal decisions and commitments, we strongly recommend you consult your professional financial and legal services provider. Our website uses referral links to various crypto exchanges as a means of monetization. We appreciate it if you choose to use the in-article links, but the decision is ultimately yours.

You must be logged in to post a comment.